That’s BOXX, spelled with double X, to not be confused with BOX, which is Field Inc., a supplier of cloud content material administration.

BOXX is the EA Collection Belief Alpha Architect 1-3 Month ETF.

Issued by Alpha Architect, its ETF presentation web page says BOXX is “an options-based various to an ultrashort period bond place.”

Utilizing European-style choices on the S&P 500 or an identical diversified index/shares/ETFs, the fund constructs field spreads with expirations starting from one to a few months.

European-style choices are cash-settled, so they don’t have task threat.

Contents

What Are Field Spreads?

Now we see why the ticker image is BOXX.

A field unfold is a complicated choices technique that mixes a artificial lengthy place with an equal artificial quick place, which ought to make no cash.

Nevertheless, it does generate a small quantity of income as a result of “value of carry,” which explains why ahead costs differ from spot costs.

The field unfold has a set payout at expiration whatever the directional motion of the underlying.

The revenue is derived from the distinction between the price of getting into the commerce and the mounted payoff.

The online consequence is that it behaves like a risk-free bond, mirroring the risk-free price of return.

Instance Of A Field Unfold

This instance is meant as an instance the idea of the field unfold and isn’t a precise illustration of the one utilized by the BOXX fund.

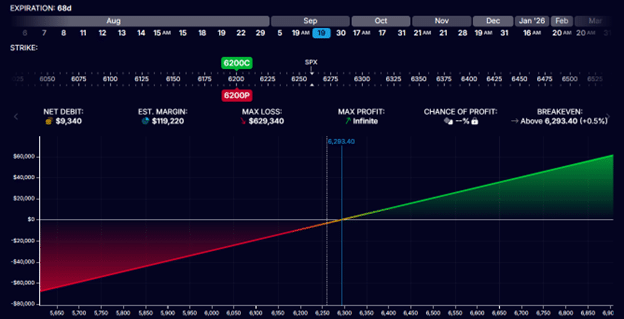

If an investor is to purchase a name possibility on the SPX on the 6200 strike and promote a put possibility on the identical strike and identical expiration, that’s about 68 days out, the investor has created an artificial lengthy place:

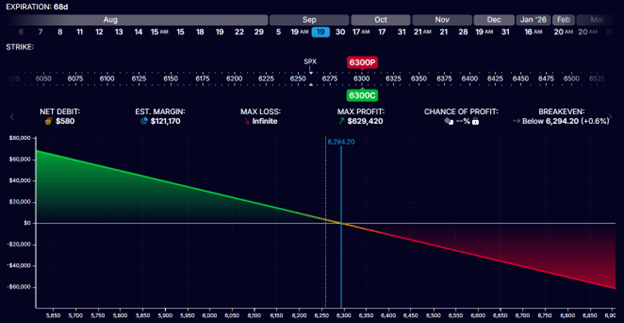

If an investor sells a name possibility on the SPX on the 6300 strike and buys a put possibility on the identical strike, the investor creates an artificial quick place…

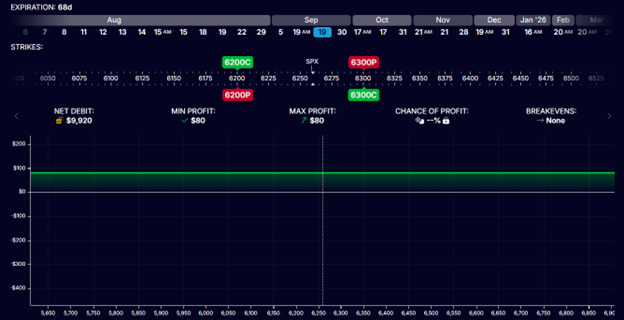

By combining all 4 legs right into a single order, the investor has created a field unfold.

As may be seen on this hypothetical simulation, the price of getting into the field unfold is $ 9,920 debit.

The BOXX fund enters the field unfold as a single order and doesn’t try to interrupt it into legs.

Additionally, you will word that the field unfold is a mixture of bull name unfold and a bear put unfold of the identical width of $100.

Subsequently, if the value of the underlying is above $6,300 at expiration, the bull name unfold receives its most revenue of $10,000, whereas the bear put unfold expires nugatory.

Since one contract controls 100 shares, we have now $100 x 100 = $10,000.

If the value of the underlying is under 6200 at expiration, the bear put unfold pays out its max revenue of $10,000 whereas the bull name unfold turns into nugatory.

If the value of the underlying is in between the 2 strikes, the mathematics would present that it too may have a payout of $10,000.

This field unfold has a payout of $10,000 at expiration whatever the worth of the underlying.

Because it solely prices $ 9,920 to enter the unfold, this field earns $80 for each $10,000 in 68 days.

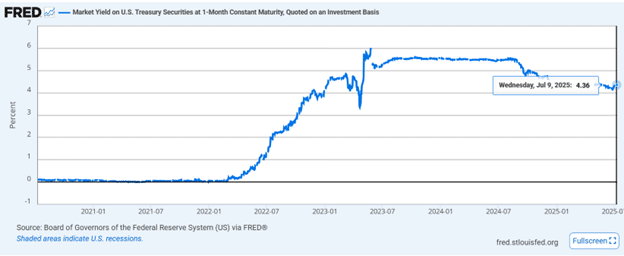

That is equal to an annualized return of 4.3%.

As a result of $80 / $10,000 * 365 / 68 = 4.3%

Efficiency Of BOXX

The BOXX fund’s efficiency goal is to realize yield and worth efficiency similar to that of the 1- to 3-month U.S. Treasury Invoice market, which, as of July 13, 2025, is 4.36% in line with FRED (Federal Reserve Financial Knowledge).

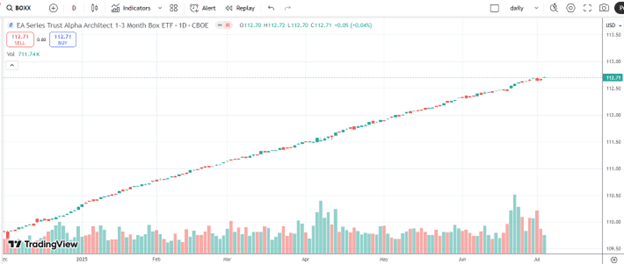

Wanting on the candlestick chart of BOXX and performing some fast math:

Free Lined Name Course

The value opened at $110.29 for one share at the beginning of 2025.

By the top of June, it had risen to $ 112.68, up $ 2.39.

By the top of the yr, one would count on to have $4.78 (if charges stay the identical)

Subsequently, $4.78 / $110.29 = 4.3% annual yield.

Sure, I’d say that BOXX efficiency matches expectations.

Comparability To BIL ETF

Can the investor purchase the BIL ETF as an alternative of BOXX?

Certain, they will.

Because the BIL invests in mounted revenue U.S. Treasuries identified to match the risk-free price of return, each BIL and BOXX ought to carry out the identical. Let’s see.

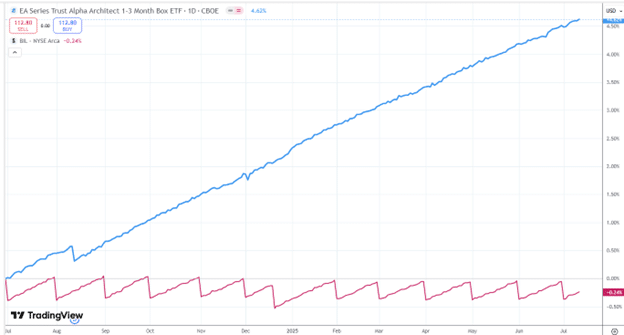

Usually, we will examine the relative efficiency of two belongings by charting each of them along with share acquire/loss on the y-axis.

For instance, right here is the relative efficiency of Pepsico (PEP), graphed on the blue line, and Coca-Cola (KO) is graphed on the purple line for the trailing 12 months…

Supply: tradingview.com

Nevertheless, this cannot be completed between BOXX (blue line) and BIL (purple line)…

It is because BIL’s NAV (web asset worth) drops each time it pays out a dividend, which is as soon as a month.

BOXX has just one dividend payout per yr, yielding roughly 0.26% yearly.

Subsequently, we have to manually compute the acquire in worth for the trailing twelve months from July 1, 2024, to June 30, 2025.

BIL opened at $91.42 and closed at $91.73, receiving a complete of $ 0.31 in dividends throughout that interval.

That represents a acquire of $4.51, or 4.9%, for the trailing twelve months.

BOXX opened at $107.84 and closed at $112.68 and acquired a complete of $0.291 in dividends throughout that very same interval.

That could be a acquire of $5.13, or 4.8%, for the trailing twelve months.

We are able to say that the efficiency of BIL and BOXX is comparable as a result of they’re each anticipated to return the risk-free price of return.

The annual price of 4.8% is barely larger on this calculation than the 4.3% as a result of the risk-free price of return was barely larger in July 2024 than it’s in July 2025.

Conclusion

The field unfold is usually used solely by institutional traders as a result of choices synthetics may be sophisticated for retail traders.

And there’s the actual hazard of constructing a mistake.

If, for instance, an American-style possibility was incorrectly used on an assignable underlying (equivalent to SPY), it’s potential for a brief choice to be assigned early earlier than expiration – notably in-the-money quick calls earlier than ex-dividend dates.

This will break the field construction and expose the investor to directional threat, the place they might lose a big sum of money if the underlying asset strikes within the improper course.

It is because of this that field spreads are restricted in sure sorts of accounts.

When you’ve got additional money mendacity round, don’t fiddle attempting to assemble field spreads.

Simply pack your money into the BOXX ETF as an alternative.

Though it has been seen that sure accounts held at sure banks have been identified to limit even the BOXX ETF.

In that case, simply purchase U.S. Treasuries through BIL.

That’s the best, and there’s no have to get any fancier, since there isn’t a good option to squeeze extra efficiency out of merchandise designed to return the risk-free price.

We hope you loved this text on the Boxx ETF.

When you’ve got any questions, ship an e mail or depart a remark under.

Get Your Free Put Promoting Calculator

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who usually are not accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.